Home Sellers Less Active in September [Video]

The September National Housing Market Report finds continued moderation. Homes are selling less quickly than in September 2021. Home inventory growth is stalling, and listing price growth is slowing. The typical home for sale spent 50 days on the market in September, a full week more than last September.

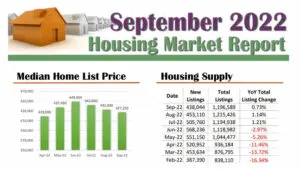

Read MoreSeptember Housing Market Continued to Moderate [Infographic]

Highlights Homes are selling less quickly than in September 2021. The national home inventory of active listings increased 26.94% over last September. Sellers are less active than last year, with newly listed homes declining by 9.8% over last September. New listings have decreased every month since June 2022. Homebuyers should see less competition and slightly…

Read MoreHow to Find the Right Real Estate Agent

According to Business Insider, first-time homebuyers represent about 27% of the real estate market. Although there is a 10% drop from what was recorded in 2021, it still constitutes a significant portion of the total annual homebuyers. Since buying or selling a home is one of the most significant transactions you’ll ever make, working with…

Read MoreHow To Use An Escalation Clause When Buying A Home

Home prices have consistently risen over the past decade. For instance, according to Statista, the median price for a single-family house stood at about $391,200 in April 2022. That represents an increase of over $100,000 since 2018. Mortgage rates have also risen significantly since the end of 2021. You’d expect these sharply higher rates to…

Read MoreWhat are the Financial and Tax Benefits of Homeownership?

Homeowners who have owned and maintained their properties in good condition can see a significant return. Even adjusting for inflation, home values tend to have positive gains over the years. Note: Consult your licensed financial tax expert before making changes in homeownership for financial and tax purposes. Home Price Trends While the average home price…

Read MoreMedian Home Prices Drop Again [Infographic]

Highlights Home listing prices decelerated for the second month in a row as of the end of August 2022. Buyers now have more active listings to choose from than at any time in the last 12 months. The national inventory of active listings in August 2022 increased by 26.6% over August 2021. Homes for sale…

Read MoreAugust Home Prices Down, Inventory Up [Video]

The August housing market report finds home listing prices are down, home inventory is up, and homes for sale are spending more time on the market. Combined, this gives buyers more choices during what is typically the best time of year to buy a home.

Read MoreRenting vs. Owning a Home

Owning a home is a life-changing decision, and it’s something to take seriously. And while homeownership is the ultimate goal for most people, owning a home has several challenging aspects. According to a press release from the Department of Housing and Urban Development (HUD) released in February 2022, over 326,000 individuals had, at one point,…

Read MoreQuestions to Consider About an Investment Property Before Buying

Successful real estate investing demands attention to detail. Careful analysis is especially important for investors who intend to purchase investment rentals or flip a property. Not adequately addressing all the elements of a real estate transaction can reduce the anticipated return or even result in financial loss. For example, overlooking weaknesses in a property, underestimating…

Read MoreHow Home Appraisals Impact Buyers and Sellers

Home appraisals are unbiased professional insights into a home’s value based on the property’s condition, location, and features. A professional assessment is required for most real estate transactions to confirm the property is worth at least as much as a mortgage lender will lend to purchase the property. Similarly, when a homeowner wishes to refinance…

Read More