What Does a Realtor Do for the Home Seller?

Just about anyone who has ever sold a home with the help of a knowledgeable Realtor appreciates the role they played in counseling, guiding, advising, and managing the process. Realtor support is especially critical during complex transactions filled with multiple crises that demand a professional hand to navigate and hold the deal together. Roles of…

Read MoreWhat is a Mortgage?

Unless homebuyers pay cash for the total price of a home, they are likely to borrow at least some of the money needed to make the purchase. Banks, mortgage companies, and other lenders offer a broad array of secured loans, known as mortgages, to help buyers realize their dream. A mortgage is a loan used…

Read MoreJanuary Existing Home Sales Decline [Video]

Nationally, newly listed homes were down an average of 9.1% in January compared to January 2021. However, homes sale overall are continuing at a rapid pace, spending on average 61 days on the market. Low inventory levels are expected to continue for several months into 2022.

Read MoreNew Home Sales Up in January [Infographic]

Highlights In January, the median home price was $375,000, the same as in December. January’s existing-home sales declined after increasing for three months. Year-over-year home price annual gains ranged from 17.5% to 18.3% as of November.

Read MoreJanuary Housing Market Report

Nationally, the number of homes listed in January was 326,312, down an average of 9.1% compared to January 2021. However, homes continue to sell at a rapid pace. The typical home spent 61 days on the market in January, ten days less than in January 2021, and more quickly than any January going back to…

Read MorePros and Cons of Paying Off a Mortgage Early

Soon after signing mortgage loan documents that lock in a 15- or 30-year debt, homeowners dream about paying off the debt early to get rid of the monthly burden. But, even if you could pay the mortgage off early, is it a good idea? When Considering Paying Off a Mortgage Early It would be nice…

Read MoreHow Do Interest Rates Affect the Housing Market?

Most prospective home buyers work with a mortgage lender to finance a home purchase. In fact, according to a U.S. Census statistic in 2020, 64.8% of current homeowners used a mortgage loan to buy their homes. As interest rates fluctuate, borrowers generally lock in fixed rates to ensure that their monthly mortgage payments remain steady…

Read MoreHow Long Does It Take to Buy a House?

The time it takes to buy a home can be a long process. According to a December 2021 Bankrate.com article, the average time to close on a home with a conventional mortgage is about 51 days. Some lenders are very efficient and can shorten that time by a few days. Government-backed FHA and VA loans…

Read MoreInventory Down, Overall Housing Market Activity Up in December [Video]

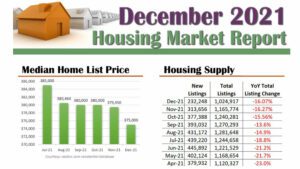

The December 2021 U.S. national housing indicators showed overall housing market activity improvement. However, the total number of unsold homes nationwide is down 16.1% from December 2020. This is a minor improvement from November’s 16.2% decline as the inventory share of listings in pending status increased slightly, a sign that buyers are active even with…

Read MoreImproving U.S. Housing Market in December [Infographic]

Highlights The median list price of homes in the December U.S. housing market was down from November but 10% higher than December 2020. November existing single-family home sales increased for the third consecutive month. Interest rates remained low in December, but lean inventories and the growth of home prices were constraining sales.

Read More